Introduction: Unveiling the Power of the 80/20 Rule

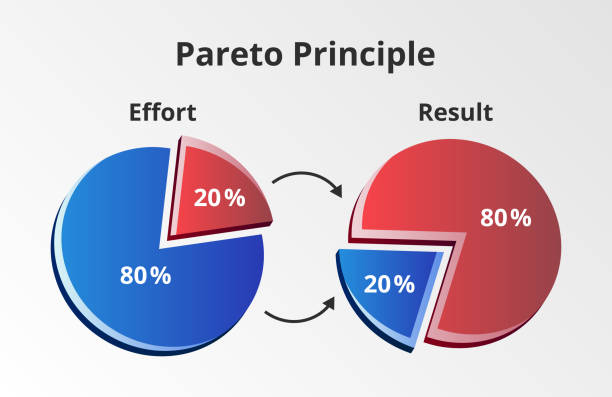

The 80/20 Rule, also known as the Pareto Principle, is a time-tested concept that states 80% of outcomes result from 20% of efforts. Applied to financial success, this principle helps you focus on high-impact actions to achieve your financial goals. In this article, we’ll delve into the details of how the 80/20 rule can reshape your financial planning and decision-making, ensuring maximum efficiency with minimal effort.

What Is the 80/20 Rule?

The Pareto Principle, developed by economist Vilfredo Pareto, originally described how 80% of Italy’s wealth was owned by 20% of its population. Today, this rule applies to various fields, including personal finance. Simply put:

- 80% of financial success comes from 20% of your key efforts.

- Identifying and prioritizing this 20% can significantly improve your financial life.

Table of Contents

How the 80/20 Rule Applies to Financial Success

Applying the 80/20 rule in finance means focusing on actions and strategies that yield the highest returns. Here’s how it works:

1. Budgeting: Focus on Major Expense Categories

Instead of tracking every minor expense, concentrate on the big ones, such as rent, utilities, and transportation. For example:

- Cutting down on dining out may save Rs. 500/month, but renegotiating your rent could save Rs. 5,000/month.

2. Investing: Identify High-Impact Opportunities

Rather than diversifying excessively, focus on key investment vehicles:

- SIPs (Systematic Investment Plans): Consistently invest in top-performing mutual funds.

- Stock Market: Research and invest in blue-chip stocks that have a proven track record.

3. Earning: Maximize High-Yield Income Sources

Invest your time and energy in high-return activities like:

- Upskilling for a promotion or a better job.

- Starting a side hustle that aligns with your expertise.

Steps to Implement the 80/20 Rule in Your Finances

Step 1: Analyze Your Financial Habits

- Aap apne income and expenses ka review karne.

- Identify areas where 20% of efforts are driving 80% of results.

Step 2: Prioritize High-Impact Actions

- Focus on reducing debt with the highest interest rates first.

- Allocate resources to investments with the highest growth potential.

Step 3: Automate Your Savings and Investments

- Use tools like SIPs or recurring deposits to ensure consistency.

- Automate bill payments to avoid late fees.

Step 4: Learn and Adapt

- Continuously educate yourself about finance through books like “The 80/20 Principle” by Richard Koch.

- Reassess your financial strategy periodically.

Real-Life Example: Applying the 80/20 Rule

Scenario: Virat, a salaried professional, earns Rs. 50,000/month and struggles with savings.

Steps Taken:

- Virat analyzed his expenses and found that 80% of his income was spent on rent, groceries, and transportation.

- He negotiated a lower rent, saving Rs. 3,000/month.

- He started a SIP with Rs. 5,000/month, focusing on high-performing funds.

- He upskilled to secure a higher-paying job within a year.

Outcome: Within two years, Raj built an emergency fund and started investing towards his dream home.

Practical Tips for Leveraging the 80/20 Rule

- Track Key Metrics: Aap Use karne budgeting apps to monitor major expenses and savings.

- Focus on Growth: Prioritize activities that increase your income or reduce significant expenses.

- Simplify Investments: Avoid over-diversifying; stick to proven investment strategies.

- Maintain Discipline: Automate processes and stick to your plan.

Conclusion: Achieve Financial Success the Smart Way

The 80/20 rule is a game-changer in personal finance journey. By identifying and focusing on the 20% of efforts that yield 80% of results, you can achieve your financial goals more efficiently. Start small, stay consistent, and watch your financial stability grow over time.

Call to Action: Have you applied the 80/20 rule to your finances? Share your experiences, tips, or ideas in the comments below. Let’s learn and grow together!

Book reference –

Title: The 80/20 Principle: The Secret to Achieving More with Less

Author: Richard KochDescription:

Ye book explain karti hai kaise aap apne time, resources, aur energy ka 20% use karke 80% results achieve kar sakte hain. Richard Koch real-life examples aur practical tips ke saath ye principle har area—business, finance, aur personal life—mein apply karne ka tareeqa share karte hain.More articles –

7 Most-Asked Questions About the 80/20 Rule in Finance

1. What is the main benefit of the 80/20 rule?

The 80/20 rule helps you focus on high-impact actions, saving time and effort while maximizing results.

2. Can the 80/20 rule be applied to debt repayment?

Yes. Pay off debts with the highest interest rates first for maximum impact.

3. How do I identify my financial 20%?

Analyze your spending, income, and investments to find areas that yield the most significant returns.

4. Is the 80/20 rule suitable for beginners in finance?

Absolutely! It simplifies financial planning and highlights essential areas to focus on.

5. Can I use the 80/20 rule to save money?

Yes. Concentrate on reducing major expenses like rent and transportation.

6. Does the 80/20 rule work for small incomes?

Yes. Even small income earners can benefit by focusing on high-impact financial habits.

7. How often should I reassess my financial 20%?

Review your financial strategy every 6-12 months to adapt to changes.