Apni life main income ke Kami ko dur karne ke liye? Or Apne Lakshya ki prapti ke lye? Income ko savdhani purvak budget banana important hai.

Present time main budgeting eke must have skill jo ki special beginner ko pata hone chahiye is artical me basic budgeting tips Ko cover Karega jise hare koi financial stable ho skate Hai, aaiye our help karte Hain aapki…

Budgeting Kya Hai? – Introduction to Budgeting for Beginners

Budgeting kya hai ? iska meaning hai ki aap apne income our expenses Ko manage kar skate ha budget aapko Apne financial target ke liya help Karega yah aapka road map ki Tara work Karega or beginner ke liye Apne expenses ko control Karne me our apni saving karne me help krega .Isa apko apnea target tak jna ke liya motivate hote rehang.

Example –

Main lijiye, aap apni dream bike kharidna chaeta ha laur kuch paisa save karna start kiya hai. Agar aap bina planning ke apne expenses karenge, toh shayad end of the month kuccha bhi save nahi hoga. Lekin agar aap ek budget set karte hain, toh aap better control aur planning ke sath apne goals achieve kar sakenge.

Apni Income aur Expenses Ka Analysis Karein – Analyze Your Income and Expenses

Budgeting ka pela step ha ki. Aapki apnea income pate hona chahiye ki aap Katina one month ma earrings hai our ouska kitna present expenses kar rah ha.

apnea income our expenses Ko analysis karain our unka record banya jisa apnea expenses ko control kar sake .

Bullet Points –

- Fixed Expenses: Yeh wo expenses hain jo har mahine same rehte hain, jaise rent, bills, aur EMI.

- Variable Expenses: Yeh expenses fluctuate karte hain, jaise groceries, shopping, aur entertainment.

Table – Example of Monthly Income and Expense Analysis

| Category | Monthly Budget | Actual Expenses | Difference |

| Income | ₹30,000 | ₹30,000 | —- |

| Fixed Expenses (Rent, EMI, Bills) | ₹15,000 | ₹15,000 | —- |

| Variable Expenses (Groceries, Shopping) | ₹10,000 | ₹12,000 | ₹-2,000 |

| Savings | ₹5,000 | ₹3,000 | ₹-2,000 |

Ek Realistic Budget Set Karein – Set a Realistic Budget

Spending habits ko jaanne ke baad, ab time hai ek realistic budget banane ka. Yeh budget practical aur achievable hona chahiye taaki aap uspe stick kar paayein.

- Har mahine ek fixed amount ko savings ke liye allocate karein.

- Apne goals ke hisaab se budget create karein. Example: Agar aapka goal 6 mahine mein ₹20,000 save karna hai, toh aapko har mahine ₹3,333 save karna padega.

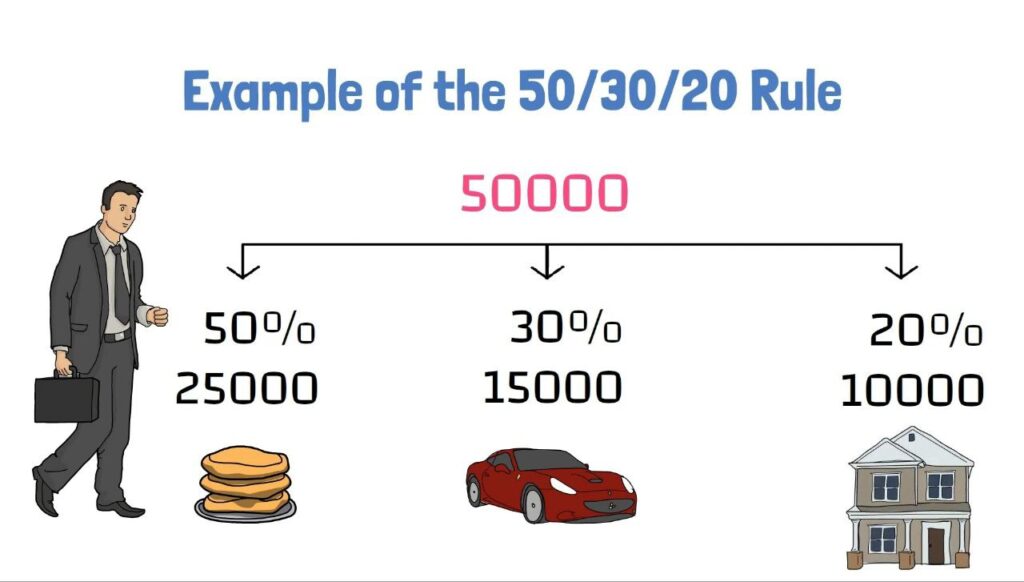

50/30/20 Rule Follow Karein – Follow the 50/30/20 Rule

Ek common budgeting rule hai jo beginners ke liye kaafi useful hai: 50/30/20 Rule. Is rule ke hisaab se aap apne income ko allocate kar sakte hain:

- 50% Essentials – Rent, groceries, bills

- 30% Wants – Entertainment, dining out

- 20% Savings and Investments

Is rule se aap apne expenses aur savings ko balance mein rakh sakte hain.

Example –

Agar aapka monthly income ₹40,000 hai, toh is rule ke hisaab se:

- Essentials ke liye ₹20,000,

- Wants ke liye ₹12,000,

- Savings Ke Liye ₹8,000 allocate honge.

Budget Track Karna Ek Habit Banayein – Make Tracking a Habit

Apnea aek perfect budget bane leya ha budget ko ache sa follow karne budget ka anusahar chalna equally important ha Budget follow karne ki habit bna la jo apko AK long term bead financial bane ma help Karega

Bullet Points –

- Monthly Review karein aur dekhein ki kaha kaha zyada kharch ho raha hai.

- Mobile Apps jaise Money Manager, Goodbudget ka use karein taaki aap apne expenses ko track kar sakein.

Example –

Ek real-life example ke liye maan lijiye, Akash ne apne expenses track nahi kiye aur bina soche shopping aur dining par kharch karta raha. Jab usne monthly review kiya, usne realize kiya ki uske zyada tar paise entertainment aur food par chale gaye.

Apne Goals Set Karein aur Motivation Banayein – Set Financial Goals and Stay Motivated

Financial goals set karna aapko ek direction aur motivation deta hai. Agar aapke goals clear hain toh aap apne budget ko easily follow kar paayenge.

Aapko apne financial goals ko set karna hoga jsa apko AK direction our motivate karne ga aap apna target ko short and long term ma divide kare apke goles clear hai to budget ko follow easily kar payanga

Bullet Points –

- Goals ko short-term aur long-term mein divide karein.

- Apne progress ko track karna motivation banaye rakhta hai.

Example –

Agar aapka goal ek emergency fund create karna hai jo 6 months ke expenses cover kar sake, toh pehle ek small amount save karna start karein aur dheere dheere ek substantial fund create karen.

Flexibility Aur Patience Rakhein – Be Flexible and Patient with Budgeting

Budget ki investigation monthly karta raha isa apko apnea income increase ha ya low hoi ha pate lag jayega iska anusahar budget ko flexible rkha apki income low ho rhi hai to budget ka ouska anurup kar la apnea budget follow nahi kar pya to next month sa try kar la patience banya rake dobra budget start kar consistent rake our believe yourself.

Conclusion

Budgeting beginners ke ak new experience and life changing thrill hoga But aap financially stable and strong ho skate ha realistic budget our consistent tracking se aapki financial journey me up our down aynge par isa ignore kar financial goal ki taraf jaye aaj se hi budgeting start kare.

Or bhi finance ke bare me janne ke liye Hamari Website check kre – TheFinancePath.com

1. Kya mujhe har mahine apna budget update karna chahiye?

Haan, aapko har mahine budget update or achhe se manage krna bahut jruri hai kyonki aapke expance or income kabhi bhi fluctuate ho sakti hain. Monthly review se aap apne budget mein zaroori changes kar sakte hain, jisse financial goals ko achieve karna aasan ho jata hai.

2. Mujhe apne expenses kaise track karna chahiye?

Expenses track karne ke liye, aap har mahine apne fixed aur variable expenses ka record rakh skte hain. Aap Money Manager ya Goodbudget jese app ki help se aap apne daily kharch ko asaani se manage aur track kar sakte hain, jisse aapko pata chalta rhe ki kaha zyada kharch ho raha hai ya kitni savings ho rhi hai.

3. 50/30/20 Rule kya hota hai?

50/30/20 Rule ek aasan budgeting strategy hai jismein aap apne income ka 50% essentials (jaise bills aur groceries), 30% wants (jaise shopping aur dining), aur 20% savings aur investments mein allocate karte hain. Yeh rule expenses aur savings ko balance karne mein madadgar hai.

4 thoughts on “Basic Budgeting Tips Jo Har Beginner Ko Pta Honi Chahiye”